Companies With 15-Plus Years of Dividend Growth

Por um escritor misterioso

Descrição

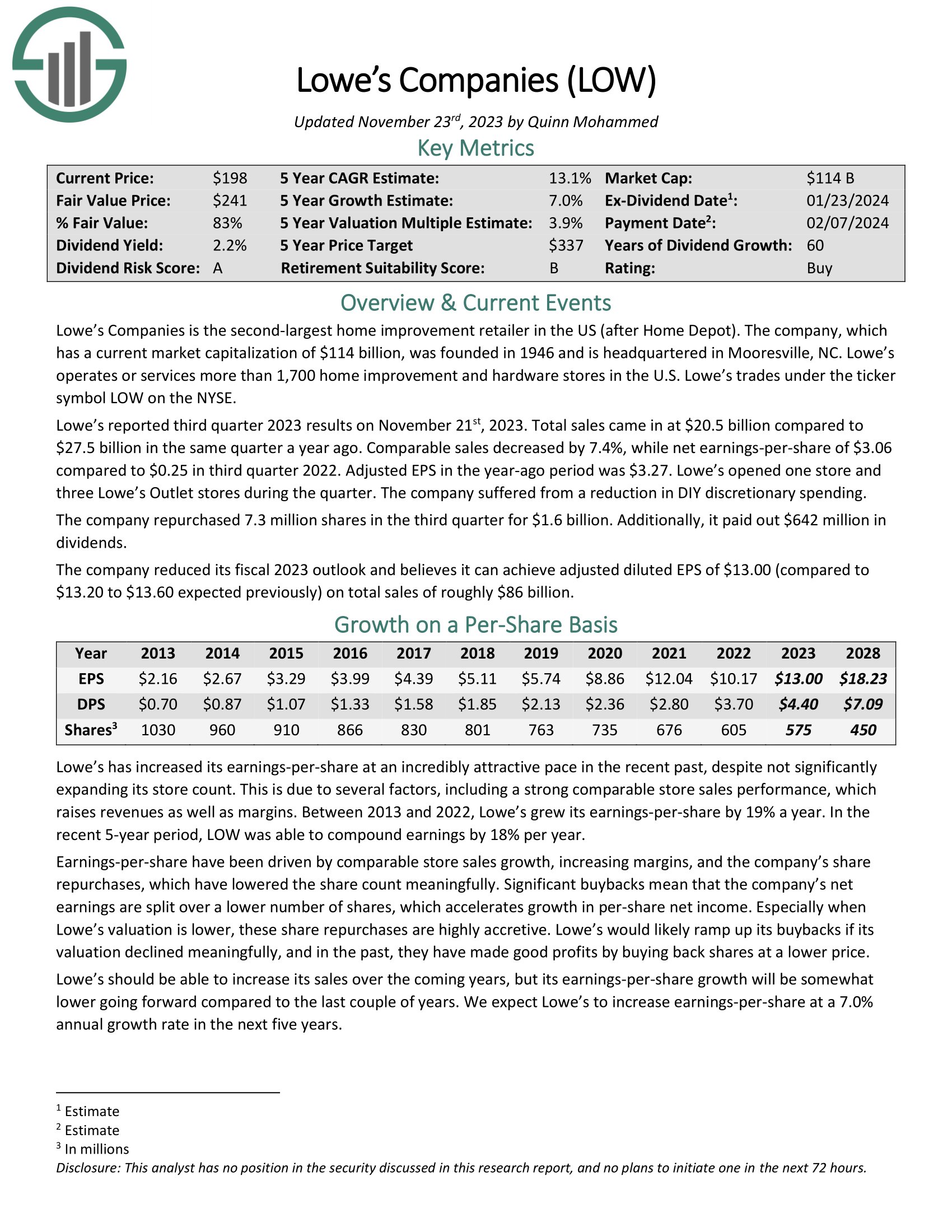

Investors are reassured – and companies consider it a point of pride – when executives note an uninterrupted track record for raising dividends. Dividend payments also offer investors a cushion on their investment, increasing the overall returns of the stock. Historically, dividend payments have accounted for more than 40 percent of the S&P 500’s total returns. Here are the top companies with 15 years or more of consecutive dividend increases.

2023 Dividend Kings List, Updated Daily

Gordon Growth Model (GGM) Formula + Tutorial [Excel Template]

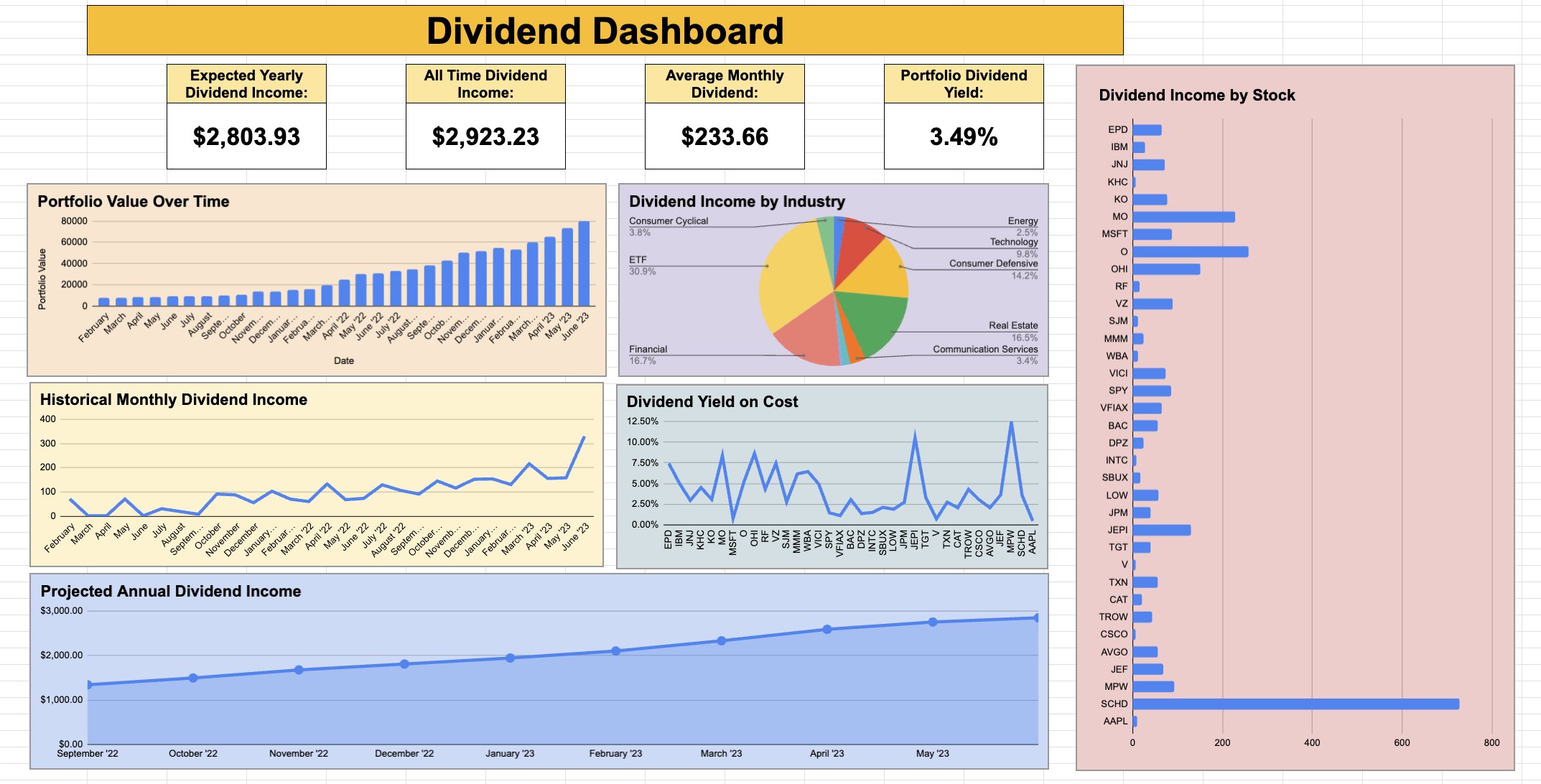

Dividendology on X: Yearly dividend income has now climbed to over $2,803! More importantly, I expect the average dividend growth rate of the companies in my portfolio to be over 10% on

Companies With 15-Plus Years of Dividend Growth

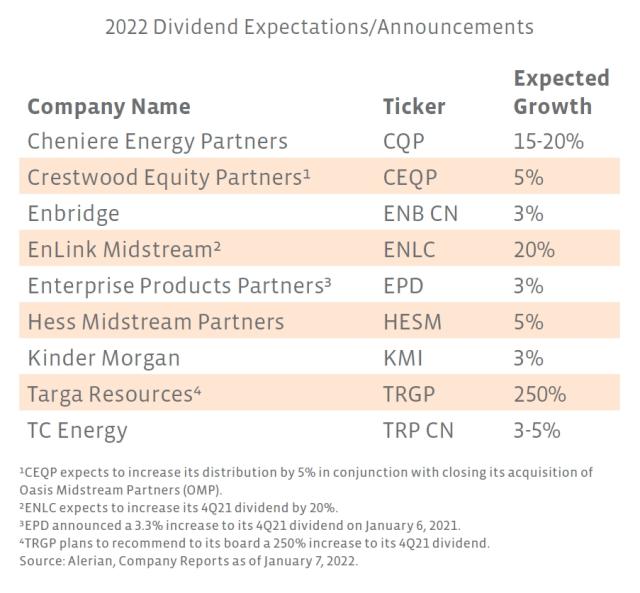

Constructive Outlook for 2022 Midstream/MLP Dividends

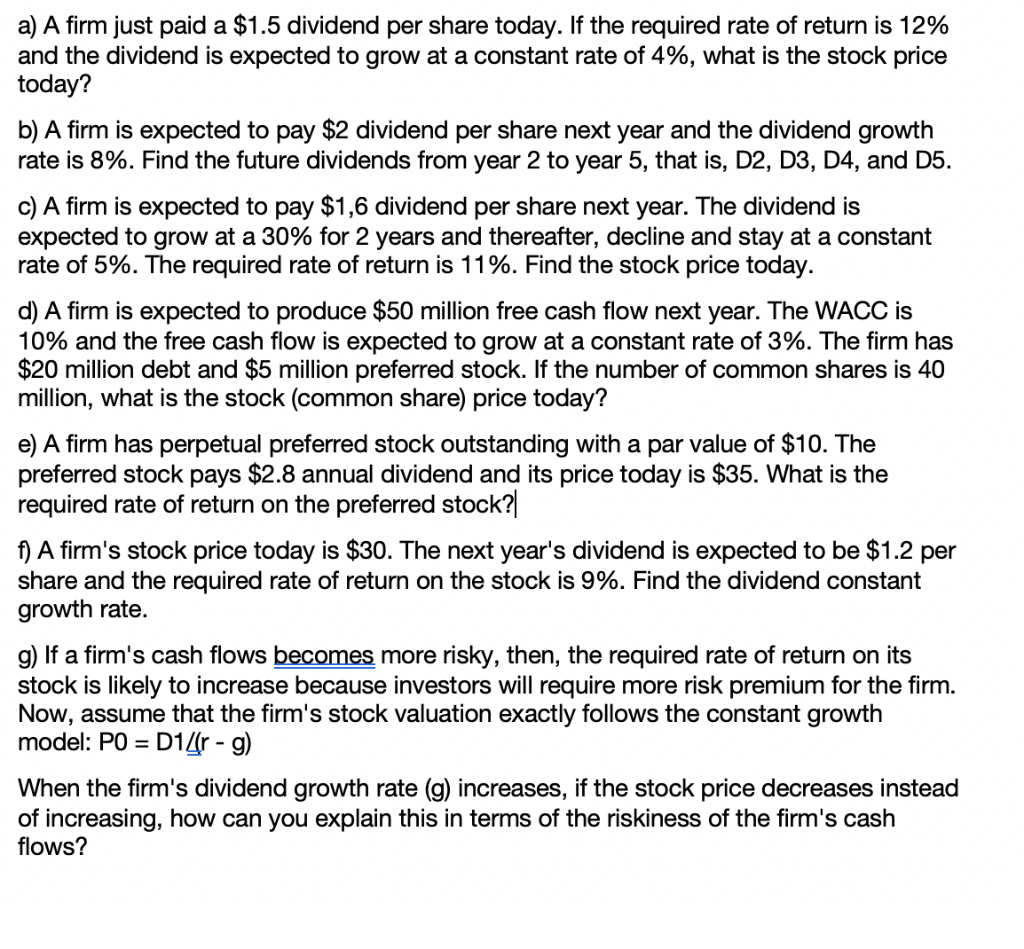

Solved a) A firm just paid a $1.5 dividend per share today.

7 Best Monthly Dividend Stocks with High Yields in 2023

Dividend vs Growth Top 7 Best Differences (with infographics)

Dividend Corporate Finance Definition + Examples

Dividend Athlete

:max_bytes(150000):strip_icc()/Dividend-44d29cb374a34b1391ec3d48b08ecab6.jpg)

Dividends: Definition in Stocks and How Payments Work

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2021/A/R/lPGDL5SJahj2iewbACnA/2015-03-12-dmc-devil-may-cry-definitive-edition-brasil.jpg)